Thailand’s industrial gases market witnessed significant developments in 2024, shaped by dynamic market demands, evolving technological advancements, and regional trade influences. Below is a comprehensive summary covering key aspects such as import/export trends, market demand, technological development, industry chain analysis, and market size.

1. Market Size and Growth

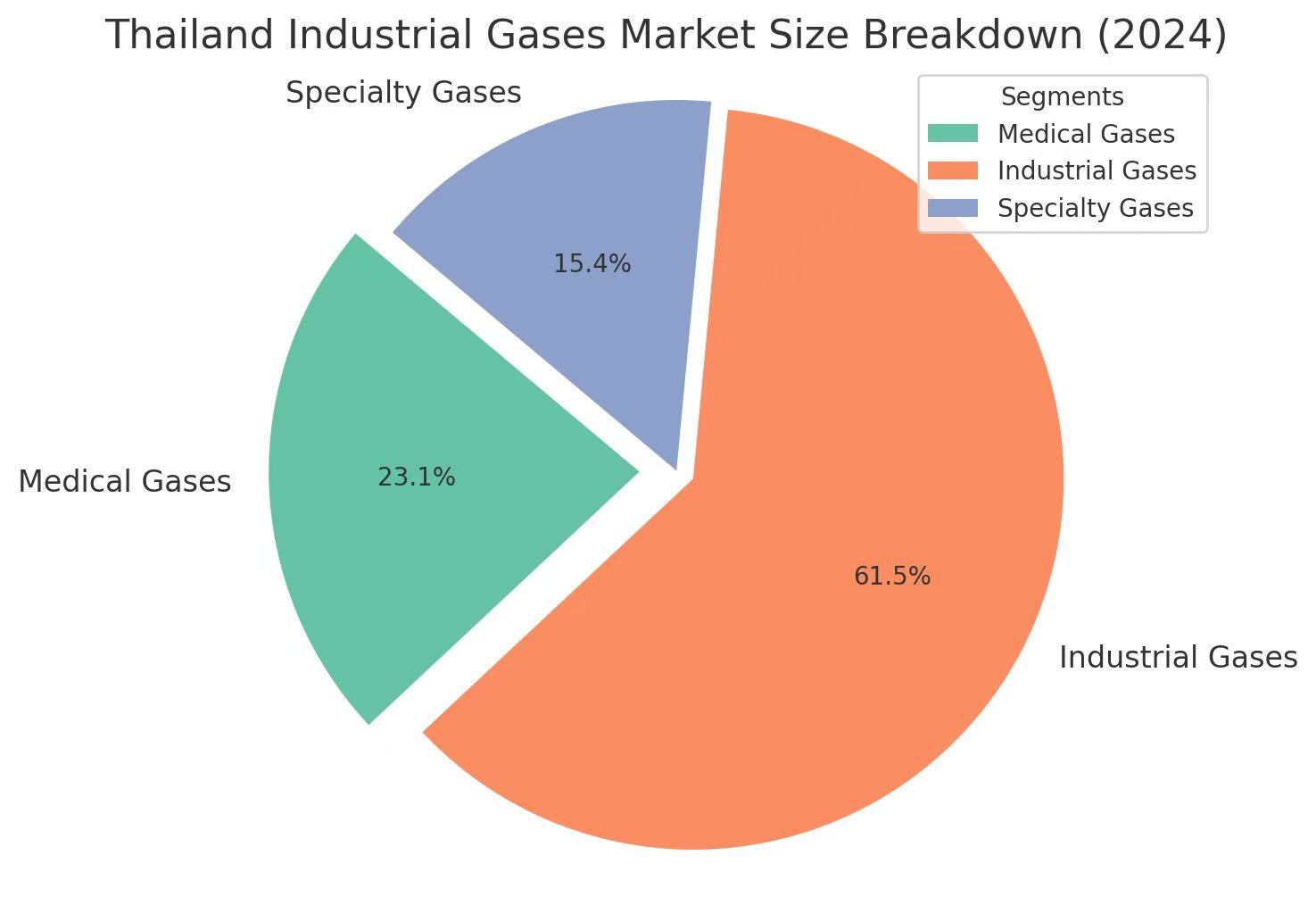

The total market size of Thailand’s industrial gases industry in 2024 reached $1.3 billion, with a compound annual growth rate (CAGR) of 7% over the past five years.

•Segment Breakdown:

• Medical gases: $300 million

• Industrial gases: $800 million

• Specialty gases: $200 million

• Regional Distribution: The Eastern Economic Corridor (EEC) remains the key hub, accounting for over 50% of market activities.

2. Industry Chain Analysis

Thailand’s industrial gases industry operates across an integrated value chain:

• Upstream: Gas extraction and production, with key suppliers including local producers and multinational corporations like Air Liquide, Linde, and Praxair.

• Midstream: Storage, transportation, and distribution networks strengthened through expanded cryogenic tank installations and upgraded pipelines.

• Downstream: Applications in manufacturing, healthcare, energy, and food industries, with rising demand for tailored gas solutions.

3. Customs Import and Export Situation

• Imports:

Thailand imported industrial gases valued at approximately $520 million in 2024, reflecting a 6% year-on-year growth. The primary imports included liquefied natural gas (LNG), oxygen, nitrogen, and helium. Key import partners were China, Japan, and South Korea, accounting for nearly 65% of total imports.

• Exports:

Exported industrial gases totaled $380 million, marking a 4% increase from 2023. Liquid oxygen and medical-grade gases were leading products. Major export destinations included Vietnam, Malaysia, Indonesia, and India.

4. Market Demand

The demand for industrial gases in Thailand grew by 8% in 2024, driven by:

• Petrochemical and Manufacturing Sectors: Increased demand for nitrogen and hydrogen in petrochemical refining and chemical production.

• Healthcare Sector: Rising requirements for medical oxygen due to healthcare expansion post-pandemic.

• Renewable Energy Initiatives: Greater utilization of hydrogen in energy storage and fuel cell projects.

• Food and Beverage Industry: Significant adoption of carbon dioxide (CO₂) for refrigeration and carbonation processes.

5. Technological Development

The industrial gas sector in Thailand focused heavily on digitization and sustainability in 2024:

• Smart Gas Distribution Systems: Several companies adopted Internet of Things (IoT)-enabled technologies for efficient gas distribution and real-time monitoring.

• Green Hydrogen Projects: Investments surged in hydrogen production through electrolysis, aligning with Thailand’s renewable energy goals.

• Cryogenic Technologies: Enhanced storage solutions were developed for liquefied gases, particularly LNG and oxygen.

• Recycling and Purification: Advanced gas recycling techniques were implemented to recover and purify CO₂ from industrial emissions.

6. Challenges and Opportunities

• Challenges:

• Rising energy costs affecting production.

• Increasing competition from regional markets like Vietnam and Malaysia.

• Environmental regulations requiring greener solutions.

• Opportunities:

• Expanding renewable energy projects fueling hydrogen demand.

• Growth in regional trade agreements facilitating exports.

• Investment in smart gas infrastructure improving supply chain efficiency.

7. Outlook for 2025 and Beyond

• The market is projected to grow at a CAGR of 8% through 2030, reaching $2 billion by 2030.

• Key drivers include Thailand’s commitment to achieving carbon neutrality by 2050 and growing industrial automation trends.

Thailand’s industrial gases market in 2024 demonstrated resilience and adaptability, with promising growth opportunities ahead. Industry players must focus on innovation, sustainability, and strategic collaborations to capitalize on future trends.

Mr. Frank Xu & Mr. SuratNawachat