The Middle East industrial gases market in 2024 showcased significant growth and transformation, driven by expanding energy projects, industrial diversification, and rising regional demand. Below is an in-depth analysis, covering customs import/export trends, market demand, technological advancements, industry chain insights, and market size.

1. Market Size and Growth

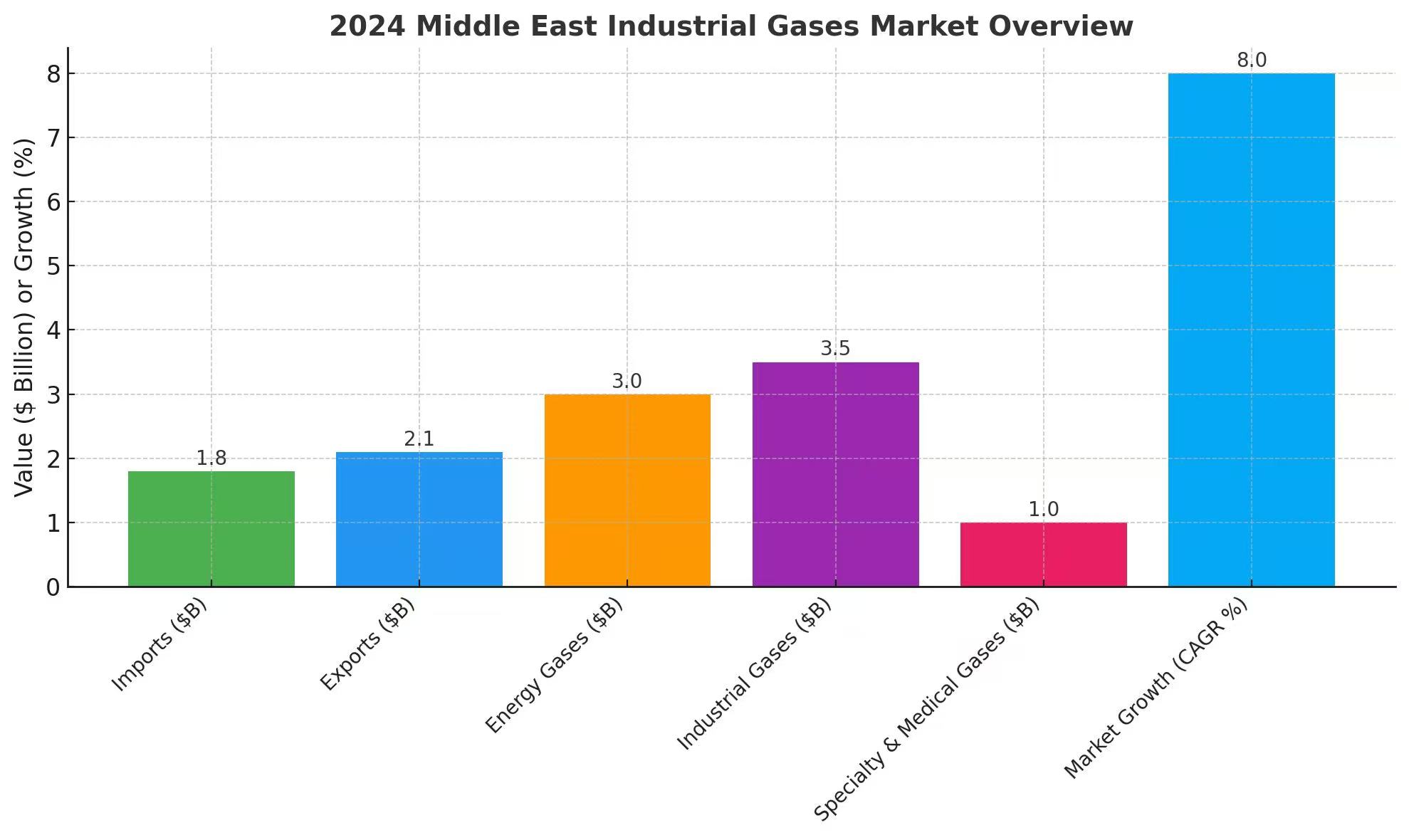

The Middle East industrial gases market reached an estimated $7.5 billion in 2024, with a compound annual growth rate (CAGR) of 8% over the last five years.

• Segment Breakdown:

•Energy gases (hydrogen, LNG, etc.): $3 billion

• Industrial gases (oxygen, nitrogen, CO₂, etc.): $3.5 billion

• Specialty and medical gases: $1 billion

• Regional Distribution:

• Gulf Cooperation Council (GCC) countries contributed over 70% of market activities, led by Saudi Arabia and the UAE.

2. Industry Chain Analysis

The Middle East’s industrial gases industry operates within a robust and interconnected value chain:

• Upstream: Gas production through local natural resources, including methane reforming and air separation units (ASUs).

• Midstream: Distribution networks improved through expanded cryogenic facilities, pipelines, and port infrastructure for exports.

• Downstream: Widespread applications across oil refining, manufacturing, healthcare, and renewable energy sectors.

Key industry players include Air Liquide, Linde, Air Products, and regional companies like Gulf Cryo and SABIC.

3. Customs Import and Export Situation

• Imports:

In 2024, the Middle East imported industrial gases worth approximately $1.8 billion, a 7% increase compared to 2023. Key imported gases included liquefied natural gas (LNG), helium, and specialty gases for advanced industries. Major import partners were the United States, China, and Germany.

• Exports:

The region exported industrial gases valued at $2.1 billion, marking a 9% growth year-on-year. Hydrogen, ammonia, and helium were the top exported gases. Primary export destinations included Europe, South Asia, and North America, benefiting from rising global demand for cleaner fuels and medical gases.

4. Market Demand

The Middle East’s demand for industrial gases grew by 10% in 2024, driven by:

• Oil and Gas Sector: Expanding use of nitrogen and hydrogen in enhanced oil recovery (EOR) and refining.

• Clean Energy Transition: Surging investments in hydrogen and ammonia production to support renewable energy initiatives.

• Healthcare Expansion: Growing need for medical-grade oxygen and nitrous oxide amid population growth and healthcare modernization.

• Petrochemical Industries: Strong demand for carbon dioxide and nitrogen for production processes.

5. Technological Development

Technological innovation has been pivotal in shaping the Middle East’s industrial gases market:

• Hydrogen Economy Advancements: Significant projects in green and blue hydrogen production, particularly in Saudi Arabia, UAE, and Qatar.

• Carbon Capture and Utilization (CCU): Development of technologies for capturing and repurposing CO₂ emissions in industries.

• Smart Gas Infrastructure: Adoption of IoT for gas monitoring, storage optimization, and distribution efficiency.

• Advanced Cryogenics: Enhanced cryogenic storage systems for LNG and liquid hydrogen.

• Electrolysis Technology: Investments in electrolysis for renewable hydrogen production.

6. Challenges and Opportunities

• Challenges:

• High energy costs affecting gas production.

• Increasing global competition in hydrogen exports.

• Regulatory pressures for sustainable operations.

• Opportunities:

• Strategic partnerships with global energy firms for hydrogen and ammonia exports.

• Investment in CCU and renewable energy projects.

• Rising regional demand for industrial gases due to industrial diversification policies (e.g., Saudi Vision 2030).

7. Outlook for 2025 and Beyond

• The market is projected to grow at a CAGR of 9%, reaching $10 billion by 2030.

• Key growth drivers include:

• Expansion of green hydrogen projects for global export markets.

• Increased adoption of industrial gases in advanced manufacturing.

• Regional governments’ commitment to achieving carbon neutrality and clean energy transitions.

Conclusion

The Middle East industrial gases market in 2024 reflected resilience and innovation, fueled by global energy shifts and regional diversification efforts. As the region positions itself as a leader in clean energy and hydrogen production, opportunities abound for businesses to capitalize on emerging trends through innovation, sustainability, and strategic alliances.

Mr. RogerSayah[MEGA] & Mr. Frank Xu