Overview

India’s industrial gases market in 2024 demonstrated steady growth, driven by increasing demand from key sectors such as healthcare, manufacturing, electronics, and renewable energy. The market has become more integrated into global supply chains, with a focus on expanding production capacity, adopting advanced technologies, and enhancing domestic capabilities in line with the “Make in India” initiative.

1. Customs Import and Export Situation

Imports

• Oxygen and Nitrogen: India increased imports of cryogenic air separation units (ASUs) to boost domestic production. Key suppliers included China, Germany, and South Korea.

• Helium: With limited domestic reserves, helium imports grew by 12% in 2024, primarily from the United States and Qatar. The dependency on imports remains a challenge due to global supply constraints and rising costs.

• Specialty Gases: Imports of high-purity specialty gases for semiconductor manufacturing and electronics increased by 18%, driven by the government’s push for self-reliance in electronics manufacturing.

Exports

• Medical Oxygen: Exports surged, especially to neighboring countries like Bangladesh, Nepal, and Sri Lanka, following India’s successful ramp-up of oxygen production during the pandemic.

•Nitrogen and Argon: Exports grew by 10%, particularly for industrial applications in Southeast Asia and the Middle East.

2. Market Demand

• Healthcare: Medical oxygen demand stabilized post-pandemic but remains a critical component of the market. The establishment of new oxygen generation plants in hospitals has driven investments.

• Renewable Energy: Green hydrogen initiatives boosted the demand for industrial gases like hydrogen and nitrogen, particularly for ammonia synthesis and fuel cells.

• Electronics: The semiconductor manufacturing sector, supported by government incentives, has significantly increased the demand for specialty gases like silane, phosphine, and nitrogen trifluoride.

• Steel and Cement: Ongoing industrial expansion has sustained the demand for bulk gases like oxygen and nitrogen for cutting, welding, and processing.

3. Technology Development

•Cryogenic Storage Innovations: Investments in cryogenic tank manufacturing have increased to support the growing demand for liquid oxygen and nitrogen.

•Digitization: Many gas companies implemented digital solutions for supply chain management and predictive maintenance of equipment.

4. Industry Chain Analysis

Upstream

• Raw materials like natural gas for hydrogen production and atmospheric air for ASU operations remain core inputs.

• Partnerships with energy providers have ensured stable electricity supplies for energy-intensive gas production processes.

Midstream

• ASU installations increased by 15% in 2024, with major players like Linde, Air Liquide, and INOX Air Products expanding capacity.

• Transportation infrastructure for liquid gases improved, with new cryogenic tankers introduced to enhance distribution.

Downstream

• Key industries like steel, healthcare, and renewable energy have become more integrated with domestic gas suppliers.

• The government’s PLI (Production-Linked Incentive) scheme encouraged the use of locally produced specialty gases in electronics and renewable energy applications.

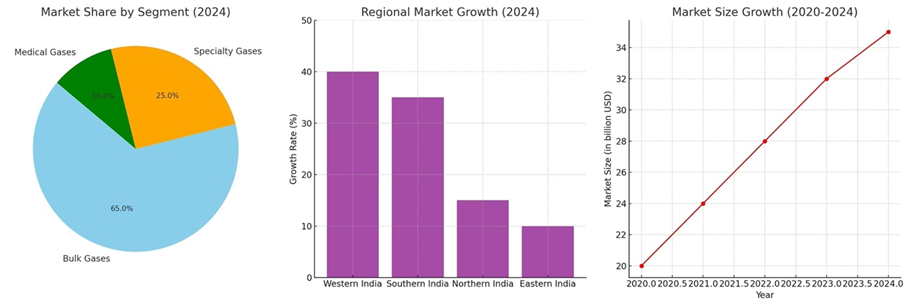

5. Market Size and Growth

•Market Size: The industrial gases market in India was valued at approximately $3.5 billion in 2024, with an annual growth rate (CAGR) of 8.5%.

•Segment Analysis:

• Bulk Gases (Oxygen, Nitrogen, Argon): Accounted for 65% of the market.

• Specialty Gases: Accounted for 25%, showing the fastest growth due to demand from the electronics and renewable energy sectors.

• Medical Gases: 10% of the market, driven by ongoing infrastructure improvements in healthcare.

•Regional Growth:

• Western India: Leading the market due to the presence of steel and chemical industries.

• Southern India: Growing rapidly, supported by electronics and semiconductor initiatives.

6. Challenges and Opportunities

Challenges

• Supply Chain Vulnerabilities: Dependence on imports for helium and specialty gases.

• Energy Costs: Rising electricity prices impacting the cost of gas production.

• Infrastructure Gaps: Limited cryogenic storage and transportation infrastructure in rural areas.

Opportunities

• Green Hydrogen: Government policies promoting hydrogen production offer significant growth potential.

• Export Potential: Growing demand for industrial gases in Southeast Asia and Africa presents opportunities for Indian exporters.

• Domestic Manufacturing: Incentives for electronics manufacturing are driving demand for locally sourced specialty gases.

Conclusion

India’s industrial gases market in 2024 showcased resilience and adaptability, aligning with global trends and domestic policies. With a strong focus on technology, sustainability, and supply chain improvements, the industry is poised for robust growth through 2030. Strategic investments in green technologies, infrastructure, and global partnerships will be crucial in driving the market forward.

AIIGMA- president Mr.TIKU& Frank XU