The industrial gas market in Korea has maintained a steady growth rate of around 10% every year.

Changes in the demand market by industrial gas are currently leading the market by increasing on-site or pipeline supply to more than 60%, unlike the liquid gas market share of more than 60% 20 years ago.

Currently, it is slowing down due to the global economic situation, but the special gas market is also growing rapidly as semiconductors, secondary batteries, LCDs, LEDs, and solar energy industries are recording growth.

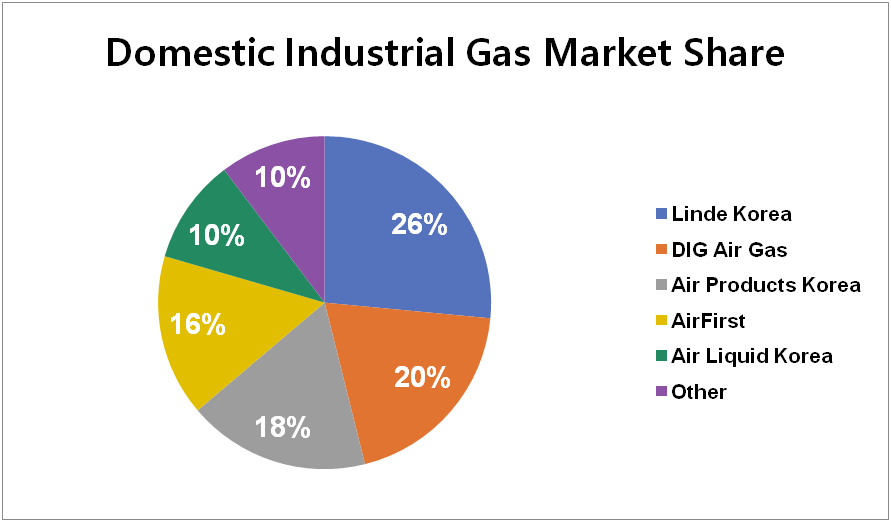

Korea's market includes global gas companies Air Products, Linde, Taiyo Nippon, and Air Liquid, and Korean companies that have installed and operated ASU include DIG Air Gas, SK Air Gas, and AirFirst.

Steel companies such as POSCO and Hyundai Steel and some secondary battery-related companies have their own ASU. In terms of the overall production volume of these companies, it far exceeds that of industrial gas manufacturers.

As manufacturers, 8 companies and about 70 large and small ASU are in operation, and most of them are located in national industrial complexes such as Ulsan, Yeosu, Gumi, and Daesan, and ASU are installed in Pyeongtaek, Giheung, Tangjeong, and Paju, where large-scale consumers such as Samsung Electronics and LG Display are located.

A total of 45 plants are owned by petrochemical companies such as POSCO, Hyundai Steel, and others, but the production of oxygen, nitrogen, and argon is about 1.6 times higher than that of manufacturers. Among them, POSCO has and operates ASUs such as 28 units and 11 units of Hyundai Steel.

Korea's industrial gas market is estimated at about $3 billion, including oxygen, nitrogen, argon, special gas, hydrogen, and carbonation, excluding the market for self-plant owners.

In the Korean gas market, the proportion of on-site and pipelines is about 50%, and Bulk tanker can be divided into 25% and cyclinder (25%).

Nitrogen and special gas are the most used industrial gas in the electronicsand display sectors in the Korean market, and the electronics andsemiconductor sectors such as Samsung Electronics, LG, and SK Hynix are the biggest consumers. The steel industry is mostly excluded from the market classification according to its own production and use, but the petro-chemical sector and the shipbuilding industry are becoming major gas demand industries.

Currently, the electronics and semiconductor sectors are the largest demandmarkets in the Korean industrial gas market. Recently, the growth of relatedindustries such as the secondary battery solar industry is also noticeable, and manufacturers and importers of SK Specialty, Hyosung Chemical, and Merck are leading the special gas market.

The Korean industrial gas market is playing a complementary role through imports and exports with neighboring countries such as China and Japan. China imports ASUs, equipment, and some special gases.

In particular, there are no ASU manufacturers in Korea, so most of them are currently imported through Chinese companies. Therefore, as a Chinese company that is geographically close, there are many opportunities for Korea to enter the ASU market.

Some Chinese companies have already been approved by KGS and are installing and operating through close business with gas companies and final consumers.

Unlike in the past, China's technology has grown a lot and accumulatedknow-how. Compared to Korea, which has a relatively small demand market,continuous R&D is continuously developing. When it comes to industrial gas, Korea relies on imports for most of its equipment and facilities due toits low marketability. So, if KGS approval is passed, I think there will be enough markets to sell cylinders, charging equipment, tube trailers, ASU, PSA,and accessories through agents or advertisements.