The Mid-Atlantic region of the US covers the overlap between the Northeastern and Southeastern states. It takes in seven states: Delaware, Maryland, New Jersey, New York, Pennsylvania, Virginia and West Virginia, plus the nation’s capital, Washington, DC.

It is densely populated. The Northeast Corridor and Interstate 95 link an almost contiguous sprawl of suburbs and large and small cities, forming the Mid-Atlantic portion of the Northeast megalopolis, which one of the world’s most important concentrations of economic activity. Not surprisingly, the area is relatively affluent as a result, having 43 of the 100 highest-income counties in the nation, based on median household income, and 33 of the top 100, based on per capita income. Most of the Mid Atlantic states rank among the 15 highest-income states in the nation, by median household income and per capita income.

The top five cities by population in the Mid Atlantic are New York City, Philadelphia, Washington, DC, Baltimore, and Virginia Beach.

The gases market

The industrial gas market in the Mid Atlantic region generated revenues of approximately $3,037.3m in 2023. This is up from $2,266.0m in 2013, indicating a compound annual growth rate of 2.97% per annum for the decade.

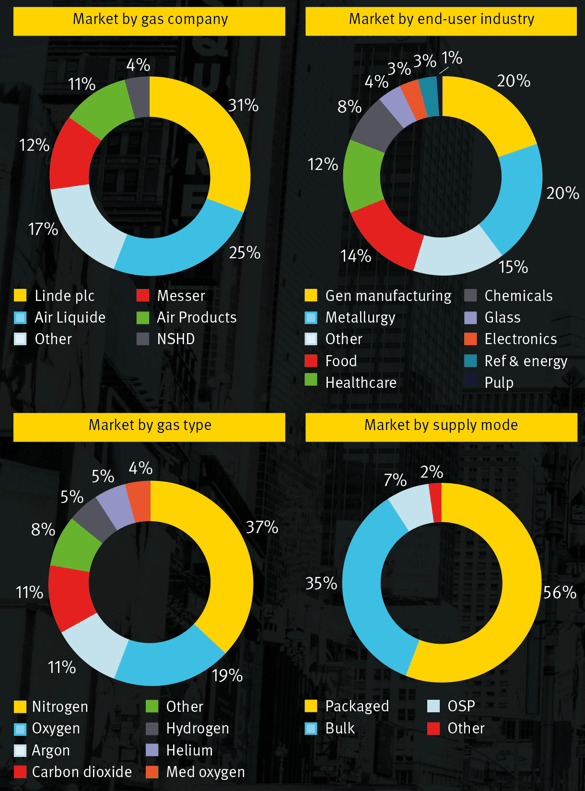

The largest gas company was Linde plc, with estimated revenues of $939.7m – equating to a market share of 30.9%. The next largest companies were Air Liquide and Messer with estimated revenues of $771.6m and $353.3m, equating to market shares of 25.4% and 11.6% respectively.

The largest revenue generating supply mode in the region was gas delivered by cylinder, accounting for an estimated $1,688.9m – this equated to 55.6% of the total gas market. Bulk sales were the second largest revenue generator, with approximately $1,062.1m (35.0%) attributable to this mode of supply, then we see on-site pipeline sales accounting for around $225.7m (7.4%).

The sale of nitrogen accounted for the largest portion of gas market revenues – approximately $1,117.9m, which equated to 36.8% of the total market. Sales of oxygen accounted for the second largest amount of revenues, and they were estimated to be around $563.8m (18.6%). Argon and carbon dioxide sales came to around $339.7m (11.2%) and $333.5m (11.0%) respectively, then comes hydrogen ($149.1m), helium ($147.8m), and medical oxygen ($128.1m). The remaining $257.3m of the market was attributable to sales of acetylene and specialty gases.

Sales to the general manufacturing sector accounted for the largest portion of gas market revenues – approximately $604.9m, which equated to 19.9% of the total market. Sales to metallurgy clients accounted for the second largest amount of revenues, estimated to be around $603.9m (19.9%). Revenues coming from food and healthcare customers came to around $434.7m (14.3%) and $379.0m (12.5%) respectively, then comes chemicals ($230.3m), glass ($117.3m), electronics ($105.3m), and refining & energy ($84.0m). The remaining $444.8m of the market was mostly attributable to a host of other end-uses of industrial gas, such as fire extinguisher manufacture, science/research applications, and wastewater treatment.

Within the 2023 to 2028 timeframe, our forecast models predict market revenue growth between 3.7% pa and 3.7% pa. Accordingly, the gas market in the region is expected to achieve revenues between $3,636.2m and $3,649.1m by the year 2028.

The region’s hydrogen bids

There are too many recent projects in the region to list them all, but let’s at least start by noting how hydrogen public policy is playing out in the Mid Atlantic region.

In April of last year, details firmed up around a Regional Clean Hydrogen Hubs program – called H2Hubs. The program earmarks up to $7bn to establish a handful of regional clean hydrogen hubs across the US. As part of a larger $8bn hydrogen hub program funded through the Bipartisan Infrastructure Law, the H2Hubs are envisaged as a central driver for clean energy and improved energy security.

Clean hydrogen hubs describe the creation of networks of hydrogen producers, consumers, and local connective infrastructure to accelerate the use of hydrogen as a clean energy carrier.

For the Mid Atlantic, three bids cover much of the region (and beyond it). The Northeast Hydrogen Hub covers seven Northeast states – Connecticut, New York, New Jersey, Maine, Rhode Island, Vermont and the Commonwealth of Massachusetts are those involved. Next to this, Team Pennsylvania Foundation has also applied and been accepted. The applicant, Team PA for short, has set up the Decarbonization Network of Appalachia (DNA) H2Hub, covering Pennsylvania, Ohio, and West Virginia, with Pennsylvania taking the lead. Finally, the Appalachian Regional Clean Hydrogen Hub (ARCH2) has been accepted in its bid covering the Northern Appalachian region, including West Virginia, Ohio, Pennsylvania, and Kentucky.

A nuclear option in hydrogen

Another piece of recent notable, and related, activity came through in March 2023, when Constellation Energy Company confirmed it has started up a 1MW demonstration-scale, nuclear-powered clean hydrogen production facility at its Nine Mile Point plant in Oswego, New York.

The plant can produce 560kg of clean hydrogen per day, which is more than enough to meet its operational hydrogen use.

Clean ammonia in West Virginia

Yet another hydrogen-angled investment landed in April last year, when plans were unveiled for a major multi-billion-dollar clean ammonia facility in Mingo County, West Virginia. as an anchor project in the Appalachian Regional Clean Hydrogen Hub’s (ARCH2) application to the Department of Energy.

The Adams Fork Energy clean ammonia project, which will be jointly developed by Adams Fork Energy and the Flandreau Santee Sioux Tribe, is expected to have initial annual ammonia production capacity of 2.1 million metric tons.

Located next to a reclaimed coal mining site, it is hoped the plant will displace more than 2.7 metric tons of carbon dioxide each year. To do this, Adams Fork Energy has signed a strategic partnership with CNX to provide fuel and carbon sequestration services.

Ammonia is one of the most efficient hydrogen carriers and it also results in zero carbon emissions when combusted. It is primarily used in agriculture as a fertilizer, but other applications include heating and power generation, refrigerant, water purification, and in manufacturing plastics, textiles, and pesticides.

Source: gasworld Business Intelligence