Given recent market and technology developments, LNG is among the most rapidly developing global energy industry sectors. Competition is getting more stringent, and governments use a broad range of stimuli, from tax benefits to direct product marketing, to promote their producers.

In April 2020, the Russian Government approved the Energy Strategy up to 2035 to maintain the international energy market share and ensure domestic energy security. Following the Energy Strategy, it is hard to achieve these goals without a substantial LNG production increase. Target LNG output is set from 80 million tpy to 140 million tpy by 2035, which will raise the LNG share of the total gas production from 4.2% in 2018 up to 22.4%.

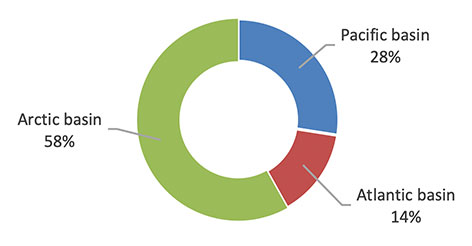

With all projects under construction and planned for up to 2035, Russia will produce up to 158 million tpy of LNGin its three main basins (Figure 1) to target different potential LNG markets.

Figure 1: Breakdown of Russian LNG projects by basins (as of January 2021). Source: AlexandeRKlimentyeV's Economic Laboratory.

LNG is an essential element of the Russian energy exports. It is valid for small (up to 80 000 tpy) and mid-sized (up to 2 million tpy), large scale Arctic, Baltic, and Far East projects.

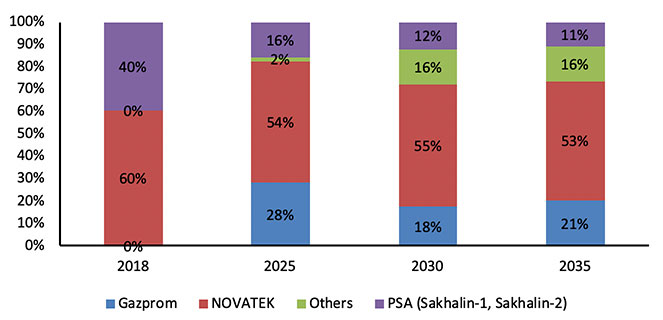

Looking at the Russian LNG projects’ detailed structures of beneficiaries, no one can doubt that NOVATEK is the critical driver of new projects. However, NOVATEK’s share in installed Russian LNG production capacity peaked in 2018, at 60%. NOVATEK’s share is not expected to grow in subsequent years, staying in a range from 50% to 60%.

With projects implemented under Product Sharing Agreements (PSA), over 75% of the planned LNG production in Russia until 2035 is supposed to be exported under exceptions to the Federal Gas Export Law amendments, excluding Gazprom production share. Therefore, it may be concluded that the Gas Export Law has lost its significance and role in maximising natural gas rent. It is especially true when it comes to the successful build-up of LNG production capacities and its exports.

Figure 2: Breakdown of Russian LNG projects by companies (as of January 2021). Source: AlexandeRKlimentyeV's Economic Laboratory.

Natural gas from Russia is exported exclusively by PJSC Gazprom's through the pipeline system, under PSA with Shell from the Sakhalin LNG plant, by NOVATEK from LNG projects in the Arctic under the Federal Law on Gas Exports exemption, and with recent changes in legislation, from other NOVATEK LNG projects.

The reason for new exemptions arose in 2020. Previously, only Yamal LNG had export rights, while other NOVATEK PJSC LNG projects lacked a legal basis to export gas. This changed in April 2020 by decree of Russian President Vladimir Putin dated 5 November 2019, No. Pr-2276, when draft amendments to the Federal Gas Export Law have been prepared. The adopted changes to the gas export law might have been called the ‘Mikhelson touch.’ As it used to be ‘the Midas touch’ in the ancient Greek mythology that turned everything into gold, in the same manner, ‘Mikhelson touch’ was to turn undeveloped gas fields into the real source of LNG exports in a short time. Therefore, it is not by chance that LNG’s liberalisation is one of the elements of the Russian energy strategy up to 2035, which enables to fully unlock LNG production potential in Russia

(To be continued)