In the previous post – Fear Will Drive Oil Prices In 2018 – I discussed the outlook for oil prices next year. In a nutshell, the price of oil will be influenced by crude oil inventories, which are going to be driven by the balance between OPEC’s actions and U.S. shale oil production.

Inventories also influence natural gas prices, but the drivers are different.

On the natural gas demand-side, growth remains robust. Pipeline exports to Mexico are surging, exports of liquefied natural gas (LNG) have reached 2 billion cubic feet/day (BCF/d), consumption in the chemical sector continues to grow, and utilities are shifting toward fast-cycling natural gas plants to complement increasing amounts of intermittent renewables on the grid.

Each of those drivers has added significantly to natural gas demand in recent years. However, natural gas production growth has kept pace.

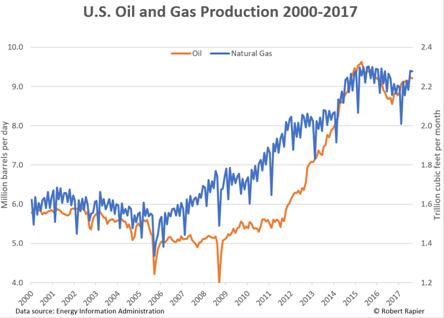

The shale revolution actually started with natural gas production, which turned upward in about 2006. Oil production began to rise in 2009, but along with it came associated natural gas. Just as the surge of shale oil production contributed to the collapse of oil prices, the surge of natural gas production – both from dedicated natural gas drilling and from associated gas production – collapsed natural gas prices.

(Click to enlarge)

Over the past decade, oil production in the U.S. nearly doubled. Natural gas production rose by about 50 percent. But the collapse in oil prices that began in 2014 caused oil production to fall, and along with it the associated natural gas production (which is reflected in the slight decline in natural gas production above).Related: Chinese M&A Wave Could Be Bad News For Investors

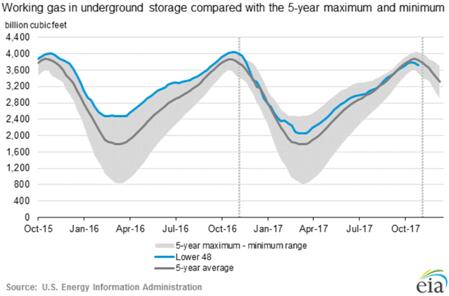

Over the past few years, natural gas production growth has outpaced demand. This caused natural gas inventories to swell, which kept downward pressure on natural gas prices. A decade ago, natural gas prices were still regularly spiking above $10/million BTU (MMBtu). Over the past three years, high inventories have mostly kept prices below $3/MMBtu.

But the turndown in natural gas production over the past year has finally brought inventories down to a normal level:

(Click to enlarge)

The decline in inventories has taken some of the downside risks out of natural gas prices and helped stabilize the price at around $3/MMBtu. Inventories are slightly below normal for this time of year, but the price of natural gas over the next six months will be mostly dictated by the weather.

If we take the weather out of the equation, $3/MMBtu is likely to stimulate more drilling for natural gas. Higher oil prices will continue to spur U.S. oil production higher, and with that production comes more associated natural gas and natural gas liquids (NGLs).

As a result of the incremental associated gas supplies, it seems likely that unless the winter is unusually cold that natural gas supplies will at least keep up with demand. In that case, natural gas prices would probably remain in the $3/MMBtu range, with the potential to move lower if oil production continues to make gains.

By Robert Rapier